The People Before Profits DSO

What Are the Investment Opportunities?

You will have

Debt

- Taxed as ordinary income

- Maturity in 36 months

Preferred Stock

- Taxed as capital gains

- Maturity in 36 months

Are There Any Requirements for Investors?

You need to qualify as an accredited Investor, which means you must have

- A net worth of $1 million, not including your primary residence

- An annual income of at least $200k individually or $300k jointly

Why Private Placement Funding?

Why Operation Dental Succeeds Where Other DSOs Fail

Our co-founder, Dr. Peter Kelly, realized early on in his career that large corporate dentistry valued profits over the best interests of dentists and patients.

On the other hand, private dentistry failed to provide a balance between life and business goals. Disheartened by his lack of options, Dr. Kelly identified a gap in the industry and envisioned a world where dentists had a better option. Operation Dental is a unique, people-before-profits dental group with a servant-leadership culture. We combine the best of both worlds with the resources, systems, and support of a large corporate DSO and the clinical autonomy and patient-centered feel of a private practice. At the core of our company is our commitment to putting our dentists and patients first.

Our unique mission and uncompromising integrity have fostered an unmatched level of employee satisfaction which reverberates throughout our organization at every level, leading to exceptional patient outcomes, fulfilled dentists and staff, soaring practice reviews, and a lucrative, thriving business.

Our distinctive values empower our dentists to focus on being great clinicians while building their wealth and reaching their financial, clinical, and personal goals. Operation Dental is a place where the company works for the dentists, not the other way around.

DENTIST testimonials

Our Mission

To learn moTo learn more about our company, culture, and history, download our executive summary here.re about our company, culture, and history, download our executive summary here.

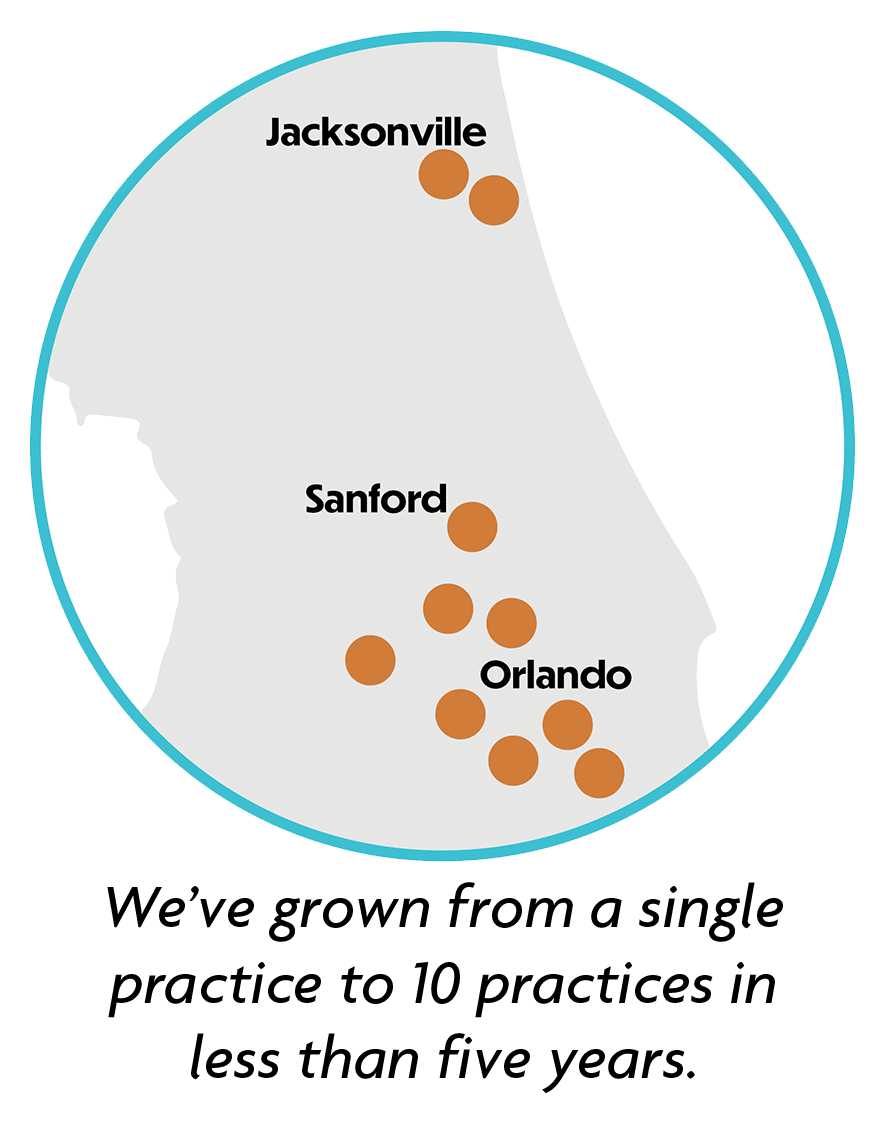

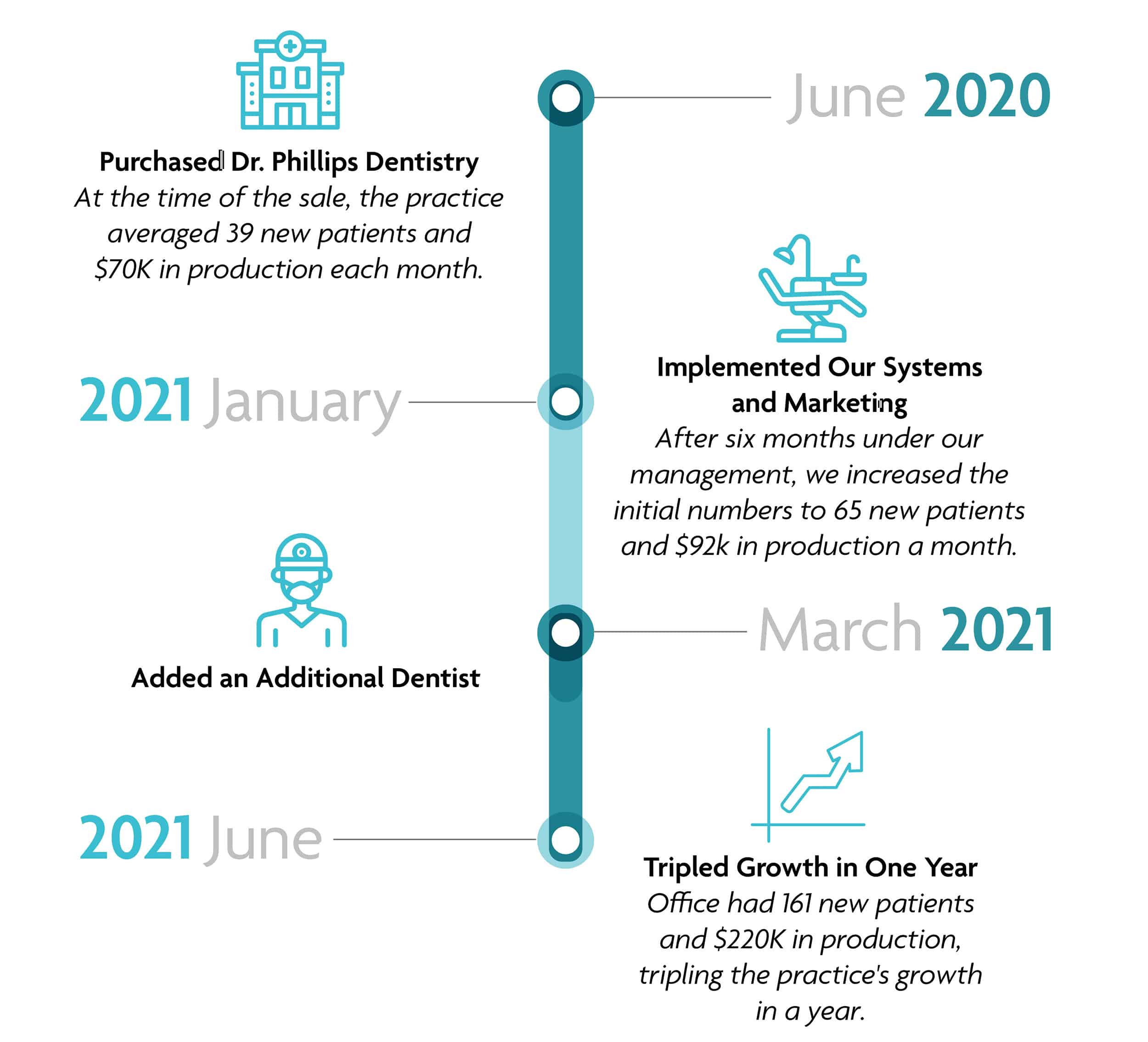

A Solid Company in Uncertain Times

Our business model has proven to be strong and reliable, with our company doubling in size year to year since 2018. Even as the global economy faltered following the COVID-19 pandemic, Operation Dental delivered solid results and experienced positive growth. Based on the Operation Dental practices we owned in the six months before and after the April 2020 COVID-19 shutdown, all practices showed significant growth with a

The dental industry is historically resilient against external crises, like the financial crisis of 2008 and now a worldwide pandemic. Staying afloat despite global economic turmoil during the COVID-19 pandemic speaks to the resilience of the dental industry, but thriving and growing in such a challenging environment speaks to the unique strength and ingenuity of Operation Dental’s business model.

A Case Study On Our Continued Success

The Florida Dental Market: An Environment For Growth

The Florida dental market is flourishing at $8.6 billion in revenue in 2021, with an estimated 3% increase each year.

America's DSO industry as a whole is also expanding, representing a $135 billion industry that continues to grow at a rate of 5 to 6% annually.

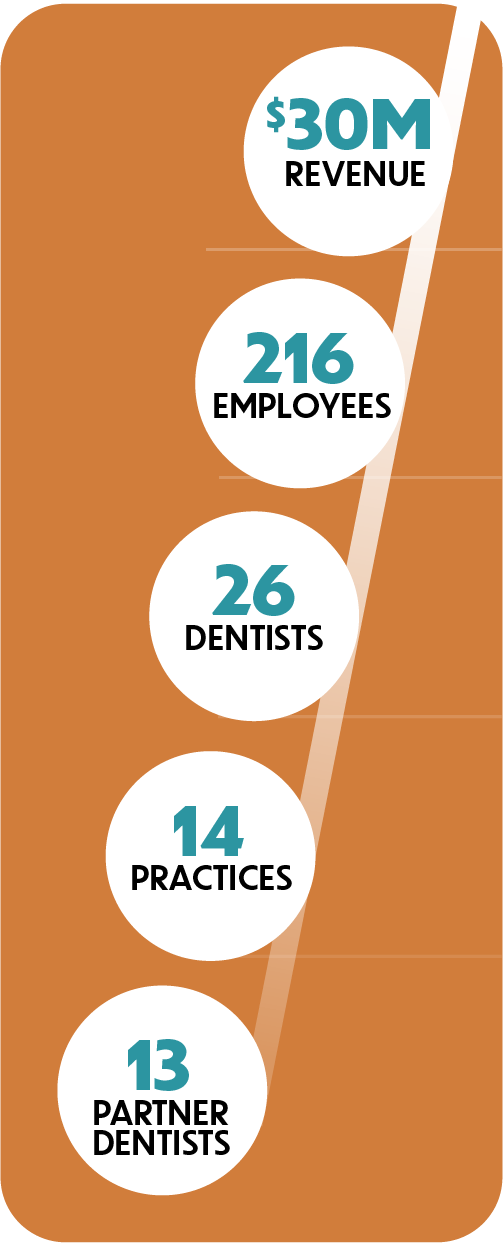

These strong statistics showcase the optimal economic environment in which we operate, priming us for stable financial growth and business expansion. We project $30 million in revenue by 2022 and at least five practice acquisitions slated across Florida for 2022 alone.

Contact Us

THE SECURITIES BEING OFFERED HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933 OR THE SECURITIES LAWS OF ANY STATE OR ANY OTHER JURISDICTION.

PRIVATE PLACEMENT OFFERINGS ARE SPECULATIVE, ILLIQUID, AND THE PURCHASE OF THESE SECURITIES INVOLVES A HIGH DEGREE OF RISK. THESE OFFERINGS SHOULD BE CONSIDERED ONLY BY PERSONS WHO CAN BEAR THE RISK OF THE LOSS OF THEIR ENTIRE INVESTMENT. ANY PERSON CONSIDERING THE PURCHASE OF THESE SECURITIES SHOULD BE AWARE OF THESE RISK FACTORS AND SHOULD CONSULT WITH HIS OR HER LEGAL, TAX, AND FINANCIAL ADVISORS BEFORE MAKING AN INVESTMENT IN THE SECURITIES.

THIS WEBSITE AND OTHER OFFERING MATERIALS MAY CONTAIN FORWARD-LOOKING STATEMENTS AND INFORMATION RELATING TO, AMONG OTHER THINGS, THE COMPANY, ITS BUSINESS PLAN AND STRATEGY, COMPANY GROWTH, AND ITS INDUSTRY. THESE FORWARD-LOOKING STATEMENTS ARE BASED ON THE BELIEFS, ASSUMPTIONS, AND INFORMATION CURRENTLY AVAILABLE TO THE COMPANY’S MANAGEMENT. WHEN USED IN THE OFFERING MATERIALS, THE WORDS “PROJECT,” “GROWTH,” “ESTIMATE,” “BELIEVE,” “ANTICIPATE,” “INTEND,” “EXPECT,” AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS, WHICH CONSTITUTE FORWARD-LOOKING STATEMENTS. THESE STATEMENTS REFLECT MANAGEMENT’S CURRENT VIEWS CONCERNING FUTURE EVENTS AND ARE SUBJECT TO RISKS AND UNCERTAINTIES THAT COULD CAUSE THE COMPANY’S ACTUAL RESULTS TO DIFFER FROM THESE STATEMENTS. INVESTORS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS, WHICH SPEAK ONLY AS OF THE DATE ON WHICH THEY ARE MADE. THE COMPANY DOES NOT UNDERTAKE ANY OBLIGATION TO REVISE OR UPDATE THESE FORWARD-LOOKING STATEMENTS TO REFLECT EVENTS OR CIRCUMSTANCES AFTER SUCH DATE OR TO REFLECT THE OCCURRENCE OF UNANTICIPATED EVENTS.

Latest News and notes

How Operation Dental Controls Supply Costs and Scales Efficiently Across Eighteen Dental Offices

Hygienist Kissy’s Role In The Beginning Of A Successful De Novo Dental Practice

Operation Dental Expands Access in Mount Dora, FL, With New Mount Dora Family Dental Office

Helping Your Patients Understand Their Dental Insurance When Coverage Does Not Equal Guaranteed Payment

Operation Dental Makes the Inc. 5000 for the 4th Year in a Row